Table of Contents

Financial literacy is becoming increasingly crucial nowadays, imparting money-management skills to children is a gift that lasts a lifetime. This article explores practical ways on how children can start to earn money while learning essential financial skills.

I. Introduction

A. Brief Overview of the Topic

A child must be financially literate like adults. We can make money management simple to learn for children. The world is getting dynamic day by day and its our duty as a parent and teachers to be understandable for children.

B. Importance of Teaching Children about Money

Children who grasp financial principles early tend to develop a healthier relationship with money as they grow. This article delves into various strategies to teach children how to earn money responsibly and cultivate essential financial habits.

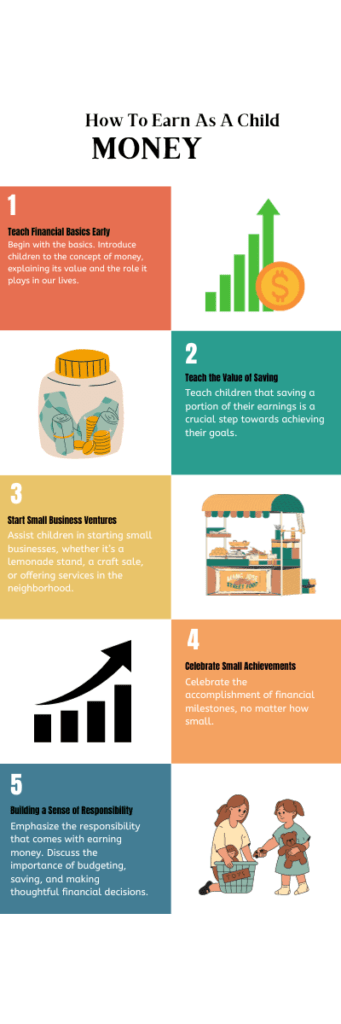

II. Teach Financial Basics Early

A. Introduce the Concept of Money

Begin with the basics. Introduce children to the concept of money, explaining its value and the role it plays in our lives. Use everyday situations to illustrate these concepts.

B. Teach the Value of Saving

Instill the habit of saving by introducing piggy banks or savings accounts. Teach children that saving a portion of their earnings is a crucial step towards achieving their goals.

C. Encourage Responsible Spending

Guide children on responsible spending habits. Help them differentiate between needs and wants, emphasizing the importance of making thoughtful purchasing decisions.

III. Foster Entrepreneurial Skills

A. Identify the Child’s Interests

Observe and identify the child’s interests and talents. This sets the stage for discovering potential entrepreneurial ventures that align with their passions.

B. Encourage Creativity and Problem-Solving

Foster creativity and problem-solving skills. Encourage children to think innovatively, as these skills are fundamental to any successful entrepreneurial pursuit.

C. Start Small Business Ventures

Assist children in starting small businesses, whether it’s a lemonade stand, a craft sale, or offering services in the neighborhood. These experiences instill a sense of responsibility and entrepreneurial spirit.

IV. Explore Online Opportunities

A. Safe Online Platforms for Children

Explore age-appropriate online platforms where children can showcase their skills or talents. Ensure these platforms prioritize safety and are closely monitored.

B. Importance of Parental Supervision

Highlight the significance of parental supervision, emphasizing that online activities should always be conducted in a safe and secure environment.

C. Teaching Online Safety

Educate children about online safety, including the importance of not sharing personal information and being cautious about online transactions.

V. Encourage Money-Saving Habits

A. Setting Financial Goals

Help children set achievable financial goals. This could include saving for a desired toy, a gadget, or even a future educational endeavor.

B. Creating a Savings Plan

Guide them in creating a savings plan. Teach the concept of allocating a portion of their earnings towards short-term and long-term goals.

C. Celebrate Small Achievements

Celebrate the accomplishment of financial milestones, no matter how small. This reinforces positive financial behavior and encourages children to continue practicing responsible money management.

VI. Learn through Real-Life Experiences

A. Trips to the Bank

Take children on trips to the bank to deposit their earnings. This real-world experience demystifies banking and reinforces the concept of saving.

B. Shopping Lessons

Involve children in grocery shopping, explaining the budgeting process and making cost-conscious choices. This hands-on experience helps them understand the value of money in everyday situations.

C. Budgeting for Family Activities

Engage children in budgeting for family activities. This not only imparts financial knowledge but also emphasizes the importance of planning and teamwork.

VII. Money Management Apps for Kids

A. Introduction to Age-Appropriate Apps

Introduce children to age-appropriate money management apps. These tools can make learning about finances fun and interactive.

B. Features of Educational Money Apps

Explore the features of educational money apps, such as budget tracking, goal setting, and interactive games that teach financial concepts.

C. Parental Control and Monitoring

Highlight the importance of parental control and monitoring when using money management apps, ensuring a safe and controlled learning environment.

VIII. The Importance of Education

A. Emphasize the Value of Education

Connect the importance of education to future financial success. Stress that investing time and effort into learning will open doors to better opportunities in the future.

B. Link Education to Future Financial Success

Demonstrate the correlation between a good education and increased earning potential. Encourage children to view learning as an investment in their future.

C. Encourage Good Study Habits

Incorporate the importance of cultivating good study habits. A strong work ethic and commitment to learning contribute significantly to future success.

IX. Promoting a Strong Work Ethic

A. Assigning Age-Appropriate Chores

Introduce age-appropriate chores to instill a sense of responsibility and work ethic. Earning money becomes a direct result of effort and commitment.

B. Discussing the Concept of Earning

Engage in open conversations about the concept of earning. Help children understand the connection between hard work and financial rewards.

C. Building a Sense of Responsibility

Emphasize the responsibility that comes with earning money. Discuss the importance of budgeting, saving, and making thoughtful financial decisions.

X. Inculcate the Value of Giving Back

A. Introduce Charitable Activities

Teach children about the joy of giving back. Introduce charitable activities that instill empathy and a sense of community responsibility.

B. Volunteering Opportunities for Children

Explore volunteering opportunities suitable for children. This not only provides a sense of fulfillment but also teaches valuable life lessons.

Conclusion

In conclusion, teaching children how to earn money is not just about financial gain; it’s about providing them with the tools for a prosperous and responsible future.

Emphasize the significance of early financial education as a foundation for a lifetime of financial well-being.